Etsy’s second quarter earnings call was held on July 31st 2024. This was a great chance to hear about what is happening in the broader economy, as well as Etsy’s ongoing strategic initiatives.

There were a substantial number of announcements and updates on that call. I am focusing on five key takeaways that I heard during this conference call.

- Continued deployment of AI technologies

- Overall stabilization of marketplace sales from earlier this year

- Mixed results with buyers

- Launch of new loyalty program called Etsy Insider

- Sharing Seller Search rank information

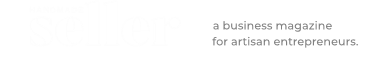

Continued deployment of AI technologies

Etsy is very clear that deployment of AI technologies is here to stay. The call talked about how technologies are being used in a variety of contexts. Many of them were common use cases that would be expected. There was one thought that may prove interesting as it is core to improving the platform.

In the example, Etsy shared how search has been enhanced with AI technologies to make sure that single shops are not dominating the search results. These are positive developments as a prospective customer does not want to see results from one shop exclusively- they are typically looking for a range of results.

Here is another example from Etsy. “To better curate merchandise to improve the buyer experience and drive GMS, we’re making it easier for buyers to find quality listings for mid-price jewelry, known as demifine, by having human experts determine what jewelry attributes are most important to a buyer’s search, think material, gold purity, or hot trends, then utilizing GenAI to infer those attributes to create new search discovery modules and pathways, and incorporate this into on-site experiences such as landing pages. While this search is very much in progress, these better on-site shopping experiences, combined with targeted marketing initiatives, such as tailored social media content, CRM efforts, and improved data feed curation for paid and organic search, contributed to a 9% year-over-year increase in GMS for demifine jewelry in the quarter.”

Look for experiments like this to continue in order to enhance the customer buying experience.

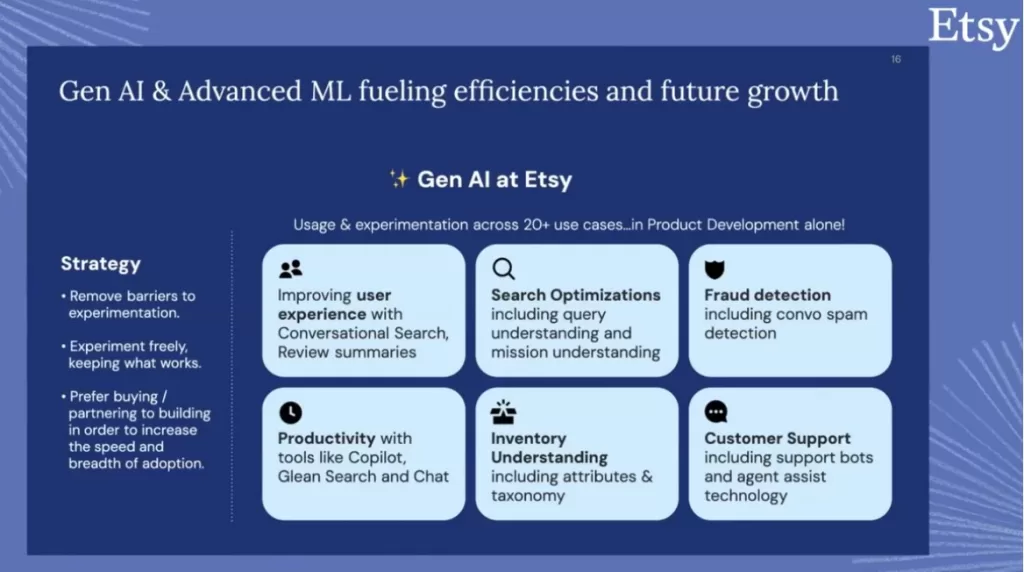

Overall stabilization of marketplace sales from earlier this year

The overall marketplace has continued to drop in four of its top six categories.

This reflects a continued further pullback in many consumer discretionary spending categories. The first three months of the year were down, and the last three months continue to be down from the first quarter. From my observations online and conversations with artisans, this is reflective of what many artisan businesses are seeing this year.

Two categories have started to reverse the losses that came earlier this year- notably for Paper and Party Supplies as well as Toys and Games.

Mixed results with buyers

Etsy often highlights its database of buyers as a key strength for the marketplace. They have one of the largest if not the largest list of buyers in our industry. However, the size of the list does not matter if you are not successfully able to activate those buyers.

The picture this quarter was very mixed. Active buyers is up 1% Y/Y. But new buyers are down 9.1%. Habitual buyers is also down 3%.Habitual buyers spent $200 or more and made purchases on six or more days in the previous 12 months. Active buyers have made one or more purchases in the last 12 months. As you can see from the graphic, it is very much a mixed picture for buyers.

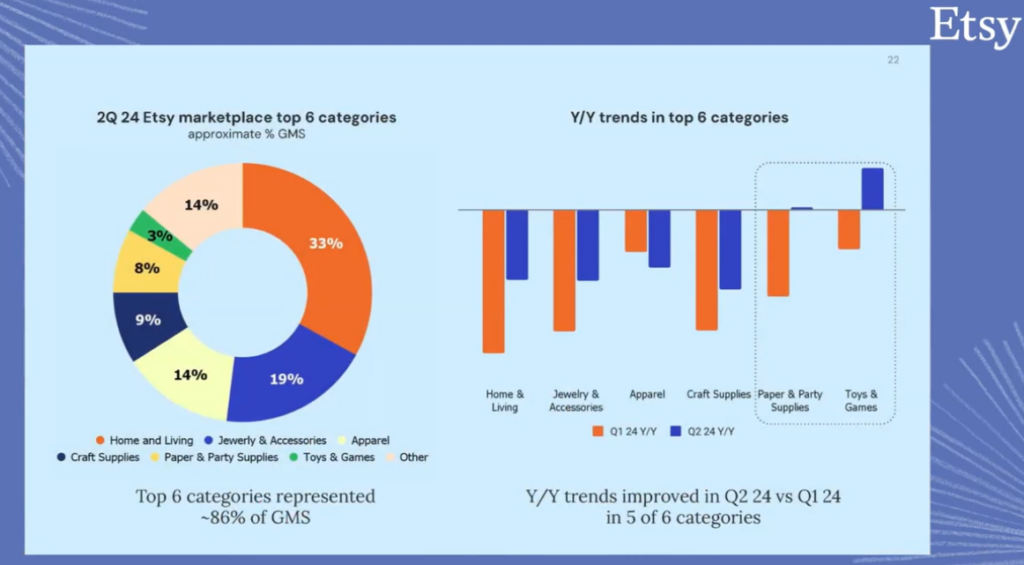

Launch of new loyalty program called Etsy Insider

They have also announced a new loyalty program for buyers. It is a test program that is invitation only for buyers (in order to not cannibalize habitual buyers). Here is what Etsy shared about the new program.

“And I want to be clear, Etsy is funding this. We’re not asking the seller to fund this. And obviously the fees we will charge to the buyers will help fund it.”

“And again, we’re not targeting our most loyal, most habitual buyers who already come to Etsy to shop for many, many of their missions. We’re targeting more occasional shoppers and seeing if we can upgrade them. So we think something in the range of the cost of a latte is probably about right.”

“It’s a de minimis impact to margins in 2024.”

Based on this information from Etsy, the best guess is that they are planning to charge $5-8 a month for this program, as they have said it will be in the range of the cost of a latte.

Etsy has clearly told their investors that sellers are not being asked to fund it. However, in the interest of transparency, I also noticed this when I looked at the sign up form for sellers to register interest in being part of the program.

The application for the program can be found at this link.

Etsy has said they will cover the cost of the shipping. So technically yes they are paying for it. At the same time they are asking sellers to effectively “pay” for the program by receiving dramatically less revenue for their items.

From the description on the form, it does not look like they are asking the same for new product Drops. I will leave you to draw your own conclusions on whether the program makes sense for your business or not. Just be aware of what is being asked to participate.

Sharing Seller Search rank information

There was no slide on this, but I think this is also worth a mention. Many Etsy sellers feel like it is hard to succeed and figure out how to win with their algorithm. Etsy has shared their plan to make that easier by sharing how they are ranking your items.

“Soon, we’ll be launching to our sellers a dashboard showing them how we score the quality of their items and the quality of their service level, creating even more of a race to the top for sellers, so they have agency over how to rank higher in search.“

Overall the call was very interesting this quarter as Etsy continues to face the broader macroeconomic headwinds. There are a number of new and interesting developments with AI we will also be monitoring. I hope you have found this analysis and summary helpful! If you would like to read the full transcript of the call, that link can be found here. The summary slides included as graphics came from the Etsy earnings call deck here.

Please consider buying a subscription to the magazine if you’d like us to continue doing in depth analysis on craft industry data. We appreciate your support!