Last month I started writing about Etsy’s financial reports, as they contain a wealth of information about the company’s strategies as well as economic information. A number of readers have expressed interest in continuing to learn more about what is in these financial reports to give overall context for Etsy’s strategies.

Like Etsy, at Handmade Seller we have a global readership. Our top five countries for readership have traditionally been the US, UK, Canada, Australia, and India- closely mirroring Etsy’s core markets. (To be fair, readership is actually growing around the world- these are the current top five). I believe it’s important to provide analysis based on what is in these reports so that readers have objective information to make decisions for your business.

If you missed the first article, you can find more information about it here.

For this article, I researched several additional questions:

- Where are Etsy’s core markets?

- What are the best selling categories on Etsy?

- How is Etsy reactivating buyers?

- What is Etsy saying about its policy enforcement practices?

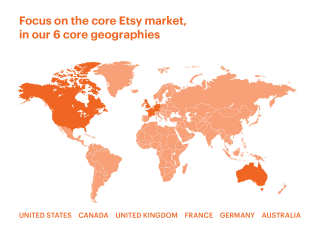

Where are Etsy’s core markets?

Etsy has buyers and sellers in most countries around the world. They have a number of different advertising initiatives for buyers and sellers around the world. However, they don’t have endless resources and cannot possibly develop every single market. There are several markets where they work to develop a vibrant base of both buyers and sellers to facilitate domestic transactions. The focus efforts to develop domestic markets in several countries are what they call their core markets.

One of the biggest changes for Etsy’s core markets in the last five years has been that they are no longer trying to develop the India domestic market of buyers. It doesn’t mean the local buyers are not there any longer, just that they are not actively developing this market. This happened in the most recent year as they scaled down from 7 core geographies where they develop domestic markets. Here is what they shared about their core markets:

“We are focused on growing the Etsy marketplace in our six core geographies (as illustrated above). Our six core markets are the United States, the United Kingdom, Germany, Canada, Australia, and France.

While we have sellers and buyers around the world, we define our core geographies as locations that meet any of the following criteria:

- represent our most attractive GMS opportunities,

- where we currently have a vibrant two-sided marketplace, or

- where we are strategically investing on the demand and supply side to accelerate domestic growth.

At this time, we are focused on bringing our vibrant community of sellers in India potential sales through cross-border, global transactions. Given we are not currently prioritizing developing a domestic marketplace in India, we no longer consider it a core geography as defined above. In addition to our primary focus on growing domestic vibrancy in our core geographies, we also see significant opportunity to further increase cross-border transactions between buyers and sellers. “

This essentially means that if you are a seller in India, Etsy is spending more effort to get cross border sales. This means awareness of the potential cost profile changes due to shipping would be wise to review.

“The last several years have been volatile for e-commerce – with periods of very strong growth as well as declines – as global economies were impacted by the COVID-19 pandemic, supply chain imbalances, geopolitical tensions, high levels of inflation, pressures on consumer discretionary spending, and more. That said, we believe the e-commerce industry continues to have significant tailwinds in terms of its long-term growth opportunity. According to the previously mentioned Euromonitor report, global e-commerce revenue in our core markets is estimated to grow by a compounded annual growth rate of 8% through 2027.

Capturing more of our total available market Using the above mentioned Euromonitor report and other data, we estimate that the online market size across all relevant retail categories for the Etsy marketplace within our six core geographic markets represents an approximately $500 billion market opportunity, and an approximately $2 trillion market opportunity when offline sales are included. The “relevant retail categories” included in our estimate of total market size are apparel and footwear, beauty and personal care, home and living, craft supplies, paper and party, art and collectibles, personal accessories and eyewear, pet care, and toys and games. We believe that since our 2023 Etsy marketplace GMS represented approximately 2% of that online only portion, we have significant opportunity to gain further e-commerce market share. Since our estimated opportunity is focused on our core geographies and retail categories, additional upside to this opportunity could come from further geographic and/or category expansion for the Etsy marketplace. “

This comment about geographic expansion is intriguing, in light of Etsy pulling back from developing a domestic market in India. Etsy then further shares information about their potential international expansion.

“Continuing international expansion may also require significant financial investment. To facilitate continued international expansion, we plan to continue investing in buyer and seller upper, mid and lower funnel marketing and enhancing the localization of the Etsy site experience (through machine translation, search optimization, and local carrier and payment methods) to help sellers and buyers transact even if they are not in the same country and/or do not speak the same language. We may engage in forming relationships with third party service providers to support operations in multiple countries, and potentially acquire additional companies based outside the United States to integrate them into our operations. Our investment outside of the United States may be more costly than we expect or unsuccessful.”

If you would like to read more about this from the financial reports, please click here.

What are the best selling categories on Etsy?

This has remained consistent for a number of years as I read through the financial reports. Here Etsy shared:

“Our top six retail categories on the Etsy marketplace in 2023 were homewares and home furnishings, jewelry and personal accessories, apparel, craft supplies, paper and party supplies, and toys and games. These categories represented approximately $10 billion, or 87% of 2023 GMS.”

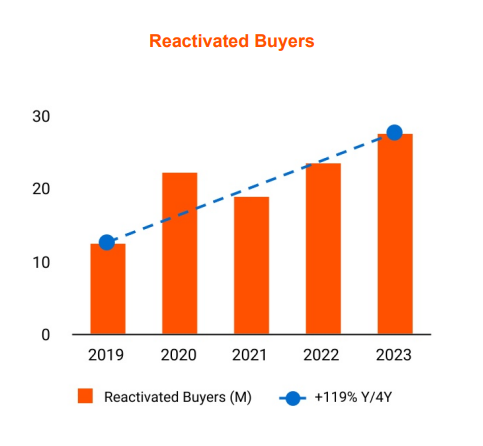

How is Etsy reactivating buyers?

As we shared in our last article, Etsy works to reactivate lapsed Buyers on their platform. On this front, Etsy has made considerable progress on reactivating buyers on the platform. The sheer number of buyers that have purchased on the platform means that at any given time, Etsy can work on reactivating buyers. The following graph shows the number of reactivated buyers (in Millions).

Esty shares ”Because buyers often “lapse” in their Etsy.com purchases (not making a purchase in a year or more), the activities outlined above in our strategy, product, and marketing sections are intended in part to reduce the number of buyers that lapse and also to re-engage lapsed buyers to get them to come back. The dramatic increase in active buyers during the pandemic resulted in more lapsed buyers in recent periods than in pre-pandemic periods, providing Etsy with opportunity to reactivate a very large pool of recently lapsed buyers. As a result of our increased focus on this opportunity, we reactivated 17% more lapsed buyers in 2023 on a year-over-year basis, with the majority located in the United States. Reactivated buyers have an approximately 40% higher LTV than new buyers in their first year back on the Etsy marketplace platform, so we expect to continue to prioritize activities to reengage lapsed buyers.”

On Policy enforcement

“In 2023, we meaningfully expanded proactive listing review and enforcement of our Handmade Policy to protect the integrity of our marketplace. For example, we removed approximately 140% more listings for violations of our Handmade Policy than in 2022, and estimate we have reduced how often buyers are seeing merchandise that appears to violate our listing guidelines by more than half since the first half of 2023. In order to protect our brand and our sellers’ unique items, we plan to expand proactive moderation capabilities while providing sellers with new tools to accurately describe their items and stay policy-adherent.”

Note- we do not see a baseline of how many items this is, just information on the percentage change. Further research was done into their transparency report, which yields some further data. Etsy releases this report each year, and you can find the one released for 2023 here.

In this report Etsy shared:

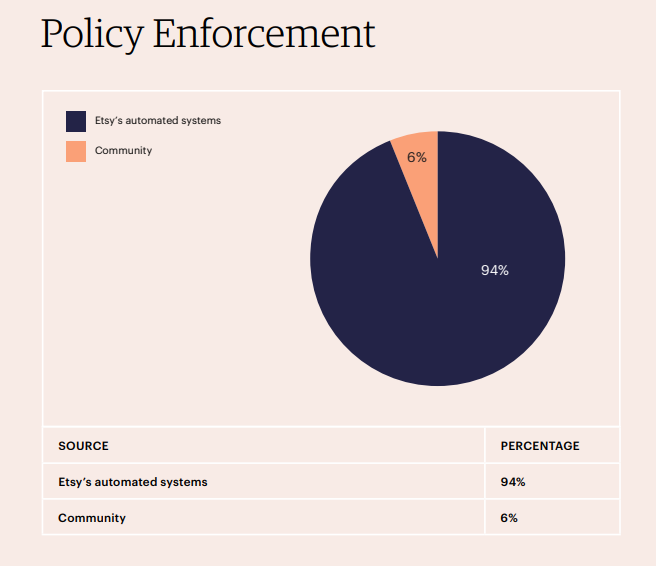

“One of our key focus areas this year was improving the accuracy of our internal automated systems that detect potentially violating listings. In 2023, we made our internal automated detection systems five times more precise than they were in 2022. This enabled us to remove more than double the number of listings (3.8M) for violating our policies compared to the year prior, while reducing the overall number of flags by 10%. 94% of our flags were generated by our internal systems. If we determine that a flagged item violates Etsy’s policies, we’ll remove the item from the marketplace and notify the seller. In some cases, and with sellers who repeatedly violate our policies, we’ll permanently refuse service to a member. In 2023, most actions were a result of alleged violations of our Intellectual Property Policy and Handmade Policy. Of the accounts we took action against in 2023, 47% were sellers based in North America and 30% were sellers based in Europe.”

Yes, you read that right. Etsy removed 3.8 Million listings for violating their policies. Seeing this data helps provide perspective on the scale of the challenge for policy enforcement on a large marketplace.

A marketplace must provide trust for both its sellers and its buyers. If buyers are coming to the platform and seeing items that are clearly not handmade, this could also cause a loss of trust in the platform.

Etsy has also developed new internal metrics to see how often buyers may be seeing items that violate Etsy’s Handmade Policy. It’s called the Not Handmade Violative View rate (VVR).

“We invested in improving our technology and expanding our detection capabilities to ensure Etsy remains the destination for special, one-of a-kind, and handcrafted items. As a result of all of these initiatives, we removed more than four times as many listings and suspended two times more sellers for violating our Handmade Policy in 2023 than the previous year. Our goal is to ensure users come across potentially violative items as infrequently as possible. To this end, we introduced a new metric in April 2023 that seeks to estimate how often users may be seeing listings that may violate our Handmade Policy, before we have the chance to remove them. We call this the Not Handmade Violative View rate (VVR). By the end of 2023, we reduced the Not Handmade VVR to the low single digits, a 60% improvement from April. A few efforts and initiatives helped us make progress in this area, including:

- Improving the precision of our automated detection systems, including enhancing the tools that help us detect when items are potentially being resold on Etsy from mass-market sites.

- Adding more human reviews to our enforcement processes. While automated systems allow us to review the millions of listings on Etsy, human reviews are critical to ensuring those decisions are accurate. Now, when a listing is flagged by our automated controls for potentially violating our Handmade Policy, it’ll remain active but not appear in search results and recommendations in order to give our specialists time to review the listing. Our team will determine if it should be removed, or if it can be sold on Etsy and be made visible again. The review process typically takes between 24 and 48 hours.

- Improving integrity across our ecosystem. In addition to our efforts to remove listings that violate our policies, we’re working to prevent non handmade items from making their way onto Etsy in the first place:

For sellers: We’re better emphasizing Etsy’s policies during the listing process. We’ve added messaging and reminders about what types of items and listing images do and do not belong on our marketplace.

For third parties: Many companies integrate with Etsy via our public API to provide sellers with a wide range of valuable tools and services. In 2023, we revoked API access to several companies whose products enable the listing and selling of mass-produced, policy-violating items. “

This last statement is the most intriguing. Given that third parties can load listings to Etsy, additional checks and balances have to be put in place to ensure that these companies are also complying with Etsy’s policies. In the technology industry, there is a term called Garbage In, Garbage Out(GIGO). If garbage data is provided, it can’t help but produce garbage. It feels like the context also applies here.

We also live in a world where there is an expectation tech companies provide access to their platforms through APIs. This is an industry trend in technology for many years. As consumers of technology, we all want integrated solutions to make it easier to move data from one system to another.

For example, we want tools that will allow us to create a listing once, but have it go to multiple platforms. This definitely makes it easier for us. But it introduces challenges for the marketplaces (not just Etsy- every marketplace that builds API’s to make this easier will have this challenge). The reality of these integrated platforms is that the integration partners also have to be policed to make sure they are enforcing the underlying policies of the platform. And they have their access to post revoked if they are violating policies. It is interesting to see that Etsy is having to kick third parties off by revoking access due to these violations. It’s a game of cat and mouse to detect and outrun the myriad of different things that emerge.

Conclusion

In this article, we are starting to see many of the complexities of growing a large company in a series of geographic core markets. At the same time that markets are developed, reactivating lapsed buyers is needed to keep domestic markets strong. Perhaps most interesting though is how the same technologies that are built to make our lives easier come with their own unique challenges.

We will keep doing analysis similar to this in the coming months, expanding our scope to other publicly traded companies in the crafts industry as well as companies whose products directly affect companies in the crafts industry.

Please consider buying a subscription to the magazine if you’d like us to continue doing in depth analysis on craft industry data. We appreciate your support!